A living trust is a legal framework to prepare an estate and protect the grantor’s assets. It can also direct the distribution of said assets after their death so that family members and beneficiaries don’t have to go through complicated and sometimes expensive probate procedures.

However, only some people know they must submit a living trust tax if they use this legal tool. Filing a living trust tax can be confusing unless you hire an estate planner or probate lawyer to help you produce all of the requirements.

- Are Living Trusts Taxed?

- Michigan Fiduciary Income Tax Return: Who Should File It?

- When to File?

- Keeping Things Simple for Trust Tax

Are Living Trusts Taxed?

A trust can hold any asset, including money, land, personal property, shares of ownership in a company, vehicles, etc. Typically, a living trust is revocable, allowing the grantor to withdraw trust funds whenever they see fit.

A federal income tax return is required if a trust earns more than $600 in a tax year. The trustee must fill out and submit Form 1041 to report the trust’s income. If one of the trust’s beneficiaries is a non-resident alien, the trust must still file a return. However, this rule has a few exceptions.

If you want to learn more about the taxation of trusts, you can read it in the Internal Revenue Code, Subchapter J, Sections 641 to 692.

Michigan Fiduciary Income Tax Return: Who Should File It?

The Internal Revenue Service (IRS) requires completing Form 1041, formerly the fiduciary income tax return, which is used to file income tax returns for trusts and estates.

The fiduciary for a personal representative for the trust must file the Michigan Fiduciary Income Tax Return or Form MI-1041 and pay the tax due. Even if no tax is due, they must file an informational MI-1041.

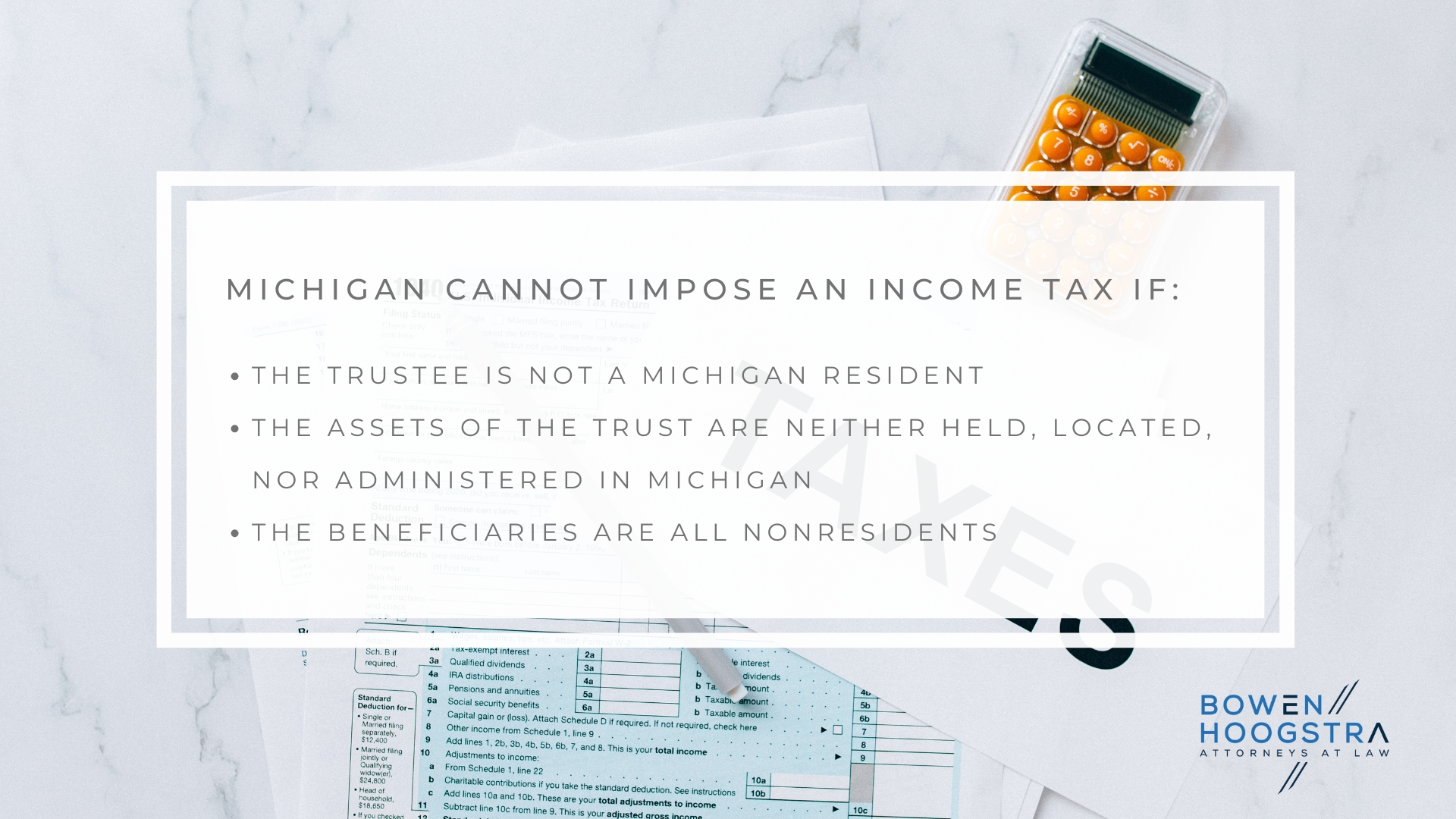

There are specific circumstances, though, that exempt individuals from having to file this form, including:

- Tax-exempt trusts, unless they have unrelated business income referable to Michigan.

- Common trust funds. The trustee must inform the beneficiaries of their share of Michigan’s fund earnings and the earnings or losses each party is entitled to under Section the Michigan Income Tax Act, Section 271.

- A non-resident trust whose income from Michigan is less than the deduction from the federal exemption.

- A grantor trust. The grantor or his representative (who is recognized as the owner of the trust’s assets) must report the trust’s income, deductions, and credits on the owner’s Michigan Individual Income Tax Return (Form MI-1040) instead of filing Form MI-1041.

- A trust rendered irrevocable at the passing of the settlor. However, they must meet all conditions of being a Michigan resident, the beneficiaries are all non-residents, and the trust is not located, held, nor administered in the state.

For more information about living trust tax, it’s best to consult a reputable lawyer in Muskegon Michigan, who can help you set up one.

When to File?

Fiduciary returns are due on the 15th day of the fourth month after the end of each tax year. If a refund is owed, it must be requested by filing a return within four years of the deadline. Save a copy of the return and all supporting schedules for six years.

Keeping Things Simple for Trust Tax

While Grantor Is Alive

The grantor is still eligible to collect the trust’s income and principal. As a result, the grantor is still subject to taxation by the IRS on trust income.

Trust-related income can be included on the grantor’s tax return since the trust can open bank accounts and investments using the grantor’s social security number. A Revocable Living Trust won’t require a separate tax return.

Although the grantor gets taxed on the income from the trust, the assets are owned by the trust, which will continue to exist after the grantor’s passing. Because of this, there is no need for the trust’s assets to go through the probate procedure.

When Grantor Is Deceased

The trust continues to exist after the grantor’s passing and is the legal owner of all trust assets. Following the grantor’s passing, the grantor’s estate and the beneficiaries are affected by the revocable trust’s tax ramifications.

The executor of the grantor’s estate files the grantor’s last tax return, which details the grantor’s income until the grantor’s passing.

Special Circumstances

If the trust’s grantor loses mental capacity, the successor trustee named in the trust documents may decide to get the trust a Employer Identification Number (EIN).

A successor trust may file for this tax ID in an effort to reduce the successor trustee’s responsibility for the trust’s income tax obligations or to facilitate the fulfillment of the successor trustee’s fiduciary obligations.

If you have any inquiries about the living trust Michigan has in place, we recommend consulting with a lawyer in Muskegon Michigan, who can give you legal advice.

Don’t Complicate Trust Tax

Just by reading this simple explanation of living trust taxation, you might already think it’s quite a complicated subject– and, quite frankly, it is!

The Bowen Hoogstra Law office is here to help you navigate legal matters related to living trust tax. We will give you a rundown of a living trust’s pros and cons and whether it is in your best interest to set one up. For more legal inquiries, you can call us at (231) 726-4484. You can also reach us here.